>FO Home >Budgets > Utility Bills >Filing a Claim

2026 Budget Consultation Presentation

At Council in Committee on Tuesday, 14 October 2025, the Chief Administrative Officer presented the attached presentation to the Council and the public. Please feel free to review the presentation and forward any comments via email to the Town at gengov@oromocto.ca. Please click here to view 2026 Budget Public Consultation.

The final budget was presented to Council on the 12 November 2025 at 5:30 pm in the Council in Committee meeting. You can see that presentation here.

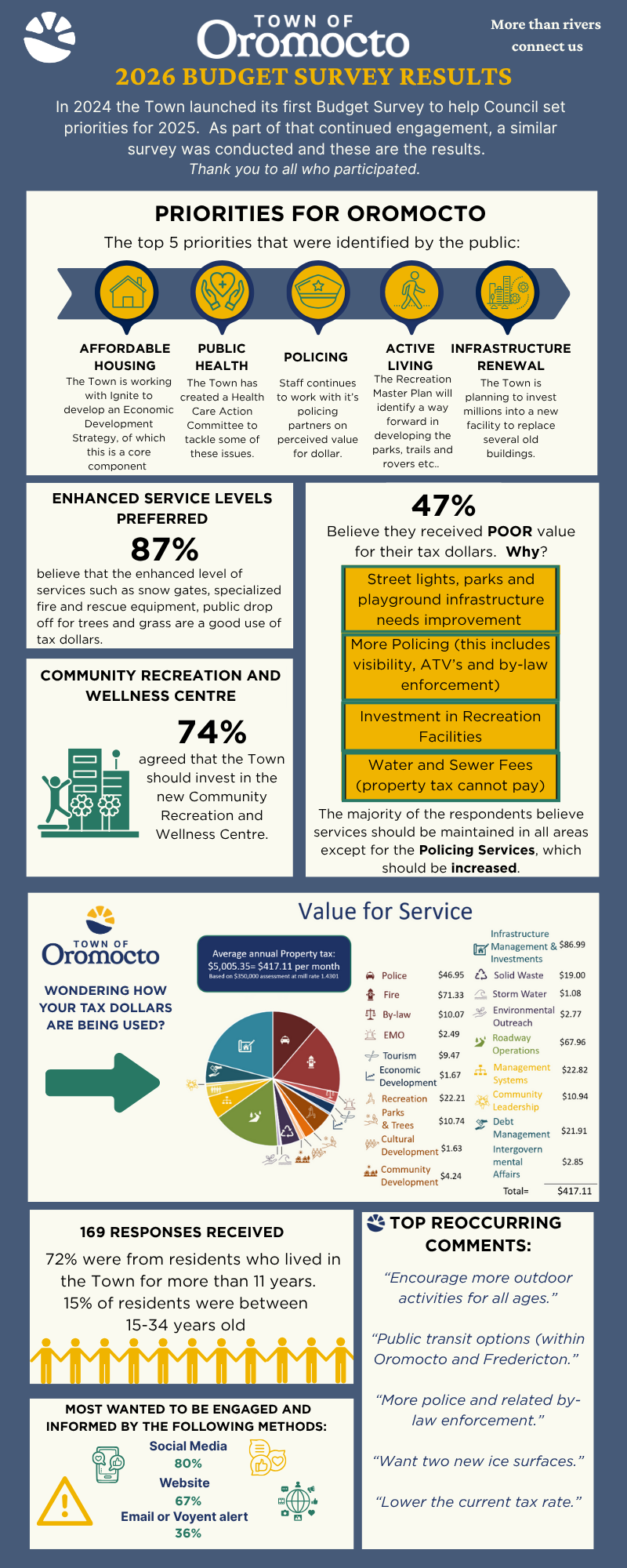

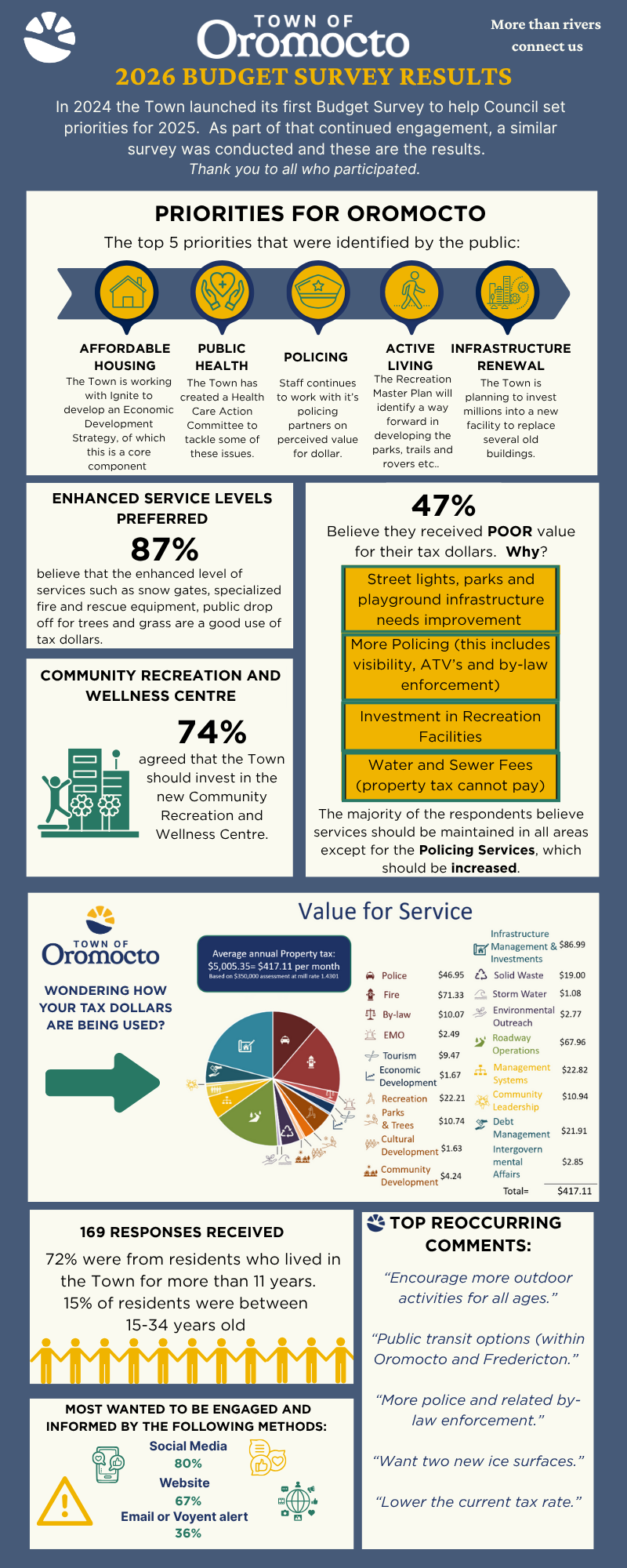

2026 BUDGET SURVEY RESULTS

FIVE-YEAR FINANCIAL PLAN

Town Council revised its Five-Year Financial Plan at its Regular Session on 21 August 2025. The objective of the plan is to provide a high-level overview of the major investments on the horizon. To view a copy of the plan, please click here.

2026 Municipal Budget(s) for the Town of Oromocto

At the Regular meeting of Council held on Thursday, 20 November 2025 the Oromocto Town Council passed resolutions to adopt

At the regular meeting of Council held on Thursday, 20 November 2025, the Oromocto Town Council passed resolutions to adopt the balanced 2026 operating ($29.11 M) and capital ($4.83 M) budgets and the utility operating ($5.73 M) and ($687 K) utility capital budgets.

HIGHLIGHTS

- Proceed with the Oromocto Community Wellness & Recreation Centre project.

- Continue catch up on some delayed capital re-investment in equipment and fleet.

- Continue dealing with the growing cost of water/sewer appropriately.

- Continue to proceed with planning of new sewage treatment solution and takeover of Base water treatment plant and wastewater treatment.

- To begin to re-invest in aging W&S infrastructure.

- To meet the major investment targets outlined in the 5-year financial plan approved by Council.

Mill Rate(s) Taxes, according to the 5-year

financial plan, were updated and approved on the 21 August 2025:

- Oromocto: Mill rate increase by 0.02 cents to 1.4501

- Lincoln: Mill rate increase of 0.04 cents to 1.0157

- Non-residential tax ratio held to max of 1.7

Water & Sewer Rates- Fixed rate to increase to $137.50/quarter but lowering consumption rate by 0.30m3 (net approx. $13.75 quarterly increase per household)

- Consumption rate stays the same at $1.65 for commercial and institutional account customers.

Council approved the following

capital budget expenditures for 2026:

Buildings:- Hazen Center beautification

- EPW Office renovation

Community Wellness and Recreational Centre:Recreation and Tourism:- Dugout protective fencing (Summerhill)

- Level outfield (Waasis)

- New fencing/rail protection

- Tables, fridge, recycling bin, trolley

- Water line/dispenser (dog park)

- New mesh on fence (Summerhill)

- Dividing fence (Summerhill)

- Concrete benches

Paving and Road Construction:

- Cyr Street

- Waasis Road (Route 102)

- Doyle Drive

- Brizley Street

Fleet and Equipment:

- John Deere mower x2

- Plow Truck

- Trackless

- One tonne dump

- TMR Radio Equipment

- Critical and technical rescue equipment

- Training site equipment

- Small vehicles (pickup truck x6, and fire x1)

Water and Sewer:- Lewis Street Forcemain

- West Sewerage Treatment Solution (design)

- Wood Street (phase 1)

- Smith Subdivision UV Treatment

Municipal Budgeting FAQs

______________________________________________________________________________________________________________________________________________________________________________________

What exactly is a budget?

A planned itemized summary of money coming into the Town and how that money will be spent over a specified period of time.

Did you know?

The Provincial Government legislates that money coming into a municipality must equal money going out? This is also known as a balanced budget!

What is the difference between an operating and capital budget?

Operating budget:

- Pays for all the day to day activities of the corporation;

- Examples of operating expenses include, salaries and wages, insurance, supplies, fuel, and utilities to name a few.

Capital budget:

- Pays for all new big investments or rehabilitation of assets currently under the Town’s control

- Examples of capital expenses include, new fire trucks, new roads, and new sewers just to name a few

How are municipal services funded?

The majority of the municipal revenue is raised through property taxes, and legally the accounts cannot go into deficit. Additional non-tax revenue sources come from facility and program fees, service fees, leases, licenses, permits and fines as well as grants, including a payment in lieu of taxes from the federal government.

What is Assessment Growth?

- Assessment growth results from property taxes that are paid primarily as a result of an expanding Town (new homes and businesses).

- These new taxes are paid to receive the same services that existing tax payers receive. Given that there are an increased number of homes and businesses requiring core municipal services, civic departments, boards and commissions have to provide an increased volume of core services.

What are Reserves & Reserve Funds?

- A reserve fund is an amount set aside for a specific purpose by authority of a by-law (or as required by legislation) that is carried from year to year unless consumed or formally closed.

- Reserves are also amounts carried from year to year, but reserves are set up by resolution of Council and are used mainly as cushions against operating budget contingencies or unforeseen events.